Reliable virtual cards for Advertisement

Credit cards for teams and individuals

For 999$ you will get 200 Cards every month throughout a year and just 1% deposit fee

Trusted by

3k+ users

Optimized for

ad platforms

Issued

200k+ cards

Advanced affiliate

card platform

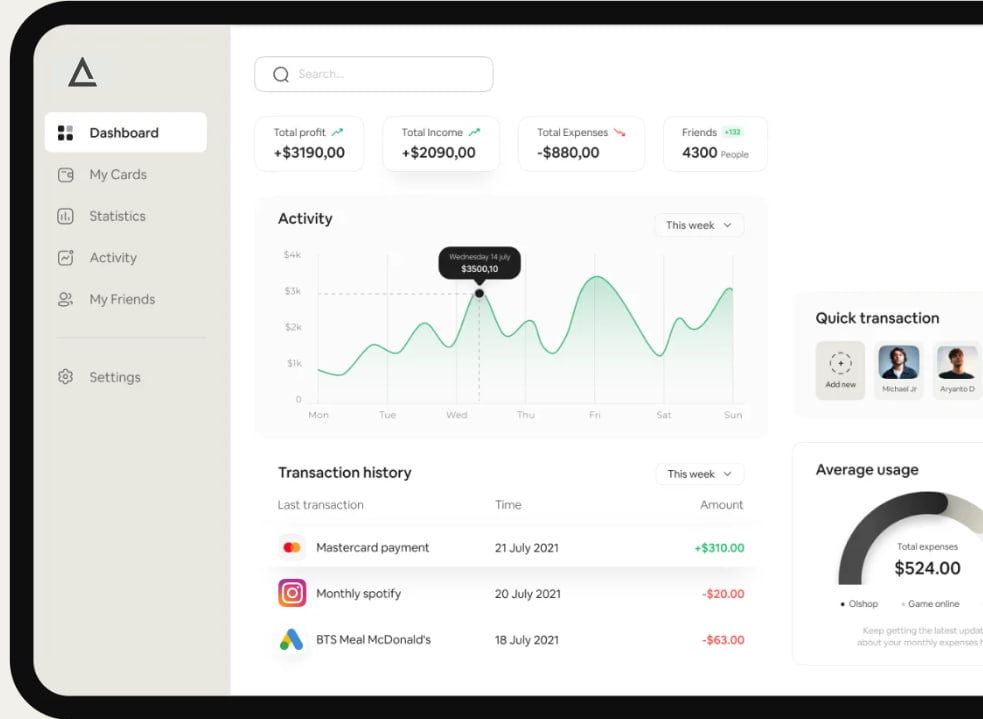

Full control

Manage and maintain cards, adjust limits and increase the performance of your campaigns and payments.

Add your team members and assign roles

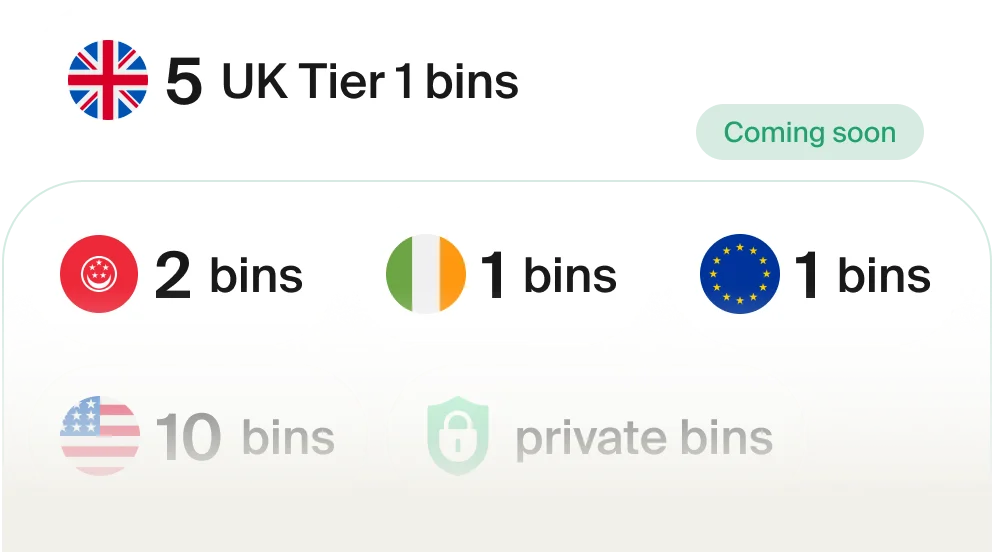

Worldwide bins

Best performing BINS are constantly updated to ensure smooth and seamless payments

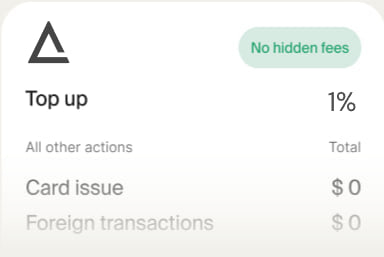

No hidden fees

No transaction fee, no decline fee, simply 1% depopsit fee

Best for retail needs

Shop online, pay for flight tickets and subscriptions to services. All our cards are available on Apple & Google Pay

Unlimited spendings and cards issues

Fast crediting of funds to the balance 24/7. You can also withdraw your funds instantly

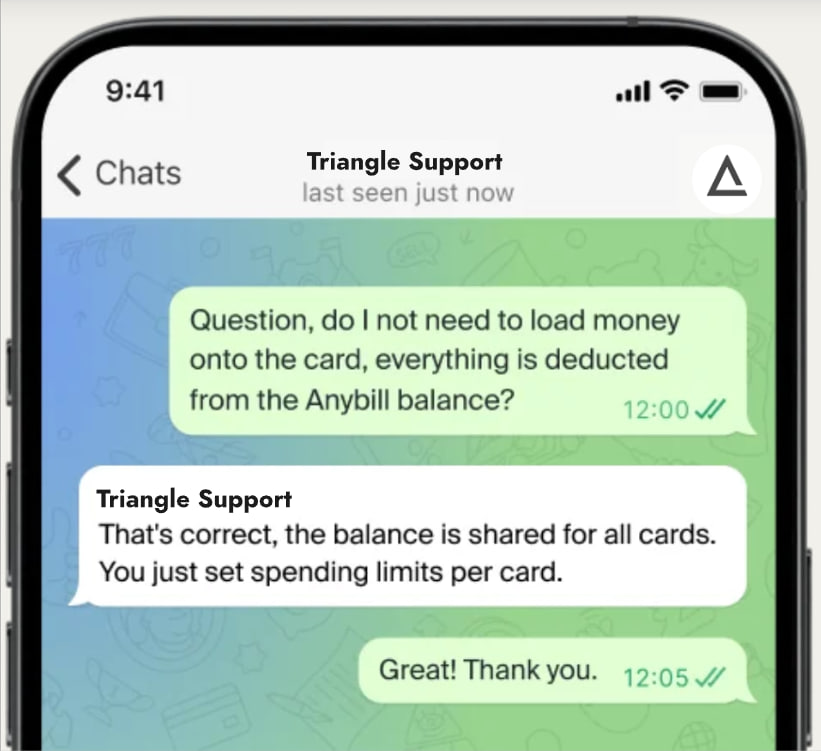

Our single balance

You no longer need to refill each card one by one, just top up your main balance and all of your cards are ready to spend

Top up with Wire or USDT

Specifically for advertising

We are experts, we know how to link our cards and we will help you

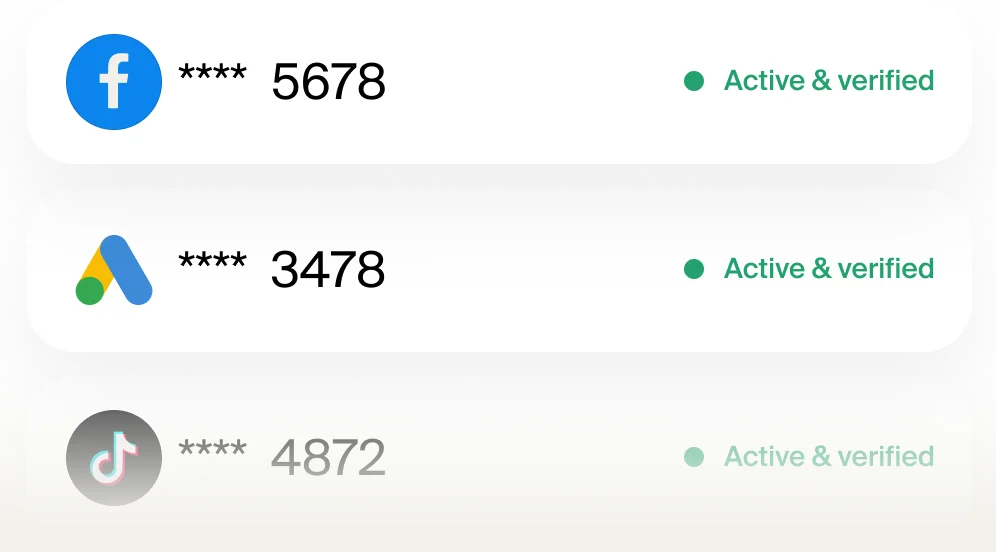

Cards for ads

Easily issue cards for advertising on Facebook, BingAds, TikTok, Google etc

High attachment rate

We ensure you that 9 out of 10 cards are successfully linked

Always ready to assist you with anything!

When will my withdrawal be completed? We will help you out with every operation to ensure a smooth experience

Are the cards not linked? We will make sure that they are successfully linked and used

All-in-one platform

Best performing platform for affiliates

Submit your application now

Upscale with Triangle

-

API

Empower your workflow through seamless integration with API.

-

Growing up together

Best market conditions will allow you to grow as the faster rate

-

One payment infrastructure

No monthly payments, just one payment to get the best conditions

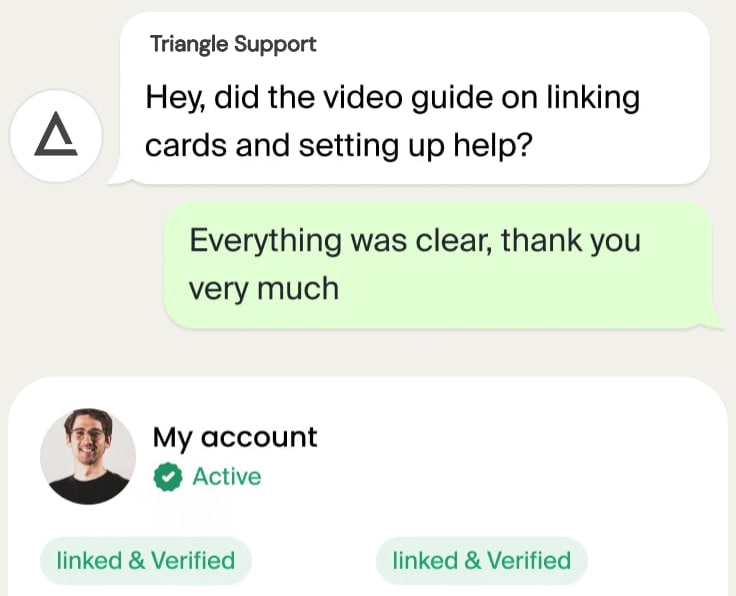

Our support team is always ready to introduce all the features to you in details

Individual & Instant Support

Get quick assistance right in your favourite messenger

Experience seamless support as we answer all your questions and requests through Telegram

Frequently Asked Questions

Get answers to commonly asked questions about our services

What is the cost of issuing a card?

Before issuing a card your application must be approved. For one time payment of 990$ you will get 100 Free cards every month and 1% deposit fee. If you reach a limit of 100 cards the cost of adding extra cards is 2$ per card.

What payment methods are available for topping up my balance?

We offer multiple payment methods for convenient top-ups. You can fund your account using wire transfers for larger amounts or USDT for fast cryptocurrency deposits. All transfers are processed 24/7, allowing you to access your funds quickly. There are no hidden fees – you only pay the flat commission for topping up, and everything else is completely free.

What payment methods can I use to top up my account?

Accepted payment options:

• USDT (TRC20)

• USDT (ERC20)

• USDC (ERC20)

Minimum deposit:

First top-up: from $150

Subsequent top-ups: from $500

What are the top-up fees?

Top-up fee is based on your monthly volume:

• €0–25,000 → 4.5%

• €25,001–100,000 → 4.0%

• €100,001–250,000 → 3.5%

• €250,000+ → Individual terms

The fee is calculated based on the total amount topped up in the previous month.

Example:

If you top up €30,000 in March, your fee in April = 4.0%.

If you top up €110,000 in April, your fee in May = 3.5%.

Are there any fees for non-euro payments?

Yes. Payments not made in euros are converted using the payment system’s exchange rate plus a 2% bank fee.

Supported payment systems:

• Mastercard

• Visa

• UnionPay

What is the Decline Rate Fee and how is it calculated?

For accounts registered after 17.12.2024:

DR ≤ 10% → €0 per decline

10% < DR ≤ 15% → €0.5

15% < DR ≤ 20% → €0.6

20% < DR ≤ 25% → €0.7

DR > 25% → €0.8

For accounts registered before 17.12.2024:

DR < 3% → €0

3% ≤ DR < 5% → €0.2

5% ≤ DR < 7% → €0.3

7% ≤ DR < 10% → €0.4

10% ≤ DR < 15% → €0.5

DR ≥ 15% → €0.6

Definition: Decline Rate (DR) is the ratio of declined transactions to total transactions over the past 7 days. Each day, your DR is recalculated.

Example: If you have 100 transactions and 12 declines in 7 days, DR = 12% → €0.5 per decline.

Important: If you process over 6,000 transactions per month, your DR must remain under 50%. Exceeding this may result in account suspension and frozen funds.

What actions are prohibited and may result in a permanent ban?

• Non-payment of ad bills

• Thresholding without real spend

• Resale of cards or using them for reselling 3rd-party products

• Using cards only for non-advertising services (e.g., Twitter Premium, YouTube Premium)

• Multi-accounting (especially after prior bans)

• Accumulating debt or declined charges with a zero balance

The service is not responsible for any charges applied by merchants or platforms to cover the client’s debt.

Do I need approval to use cards on certain platforms?

Yes. Any unauthorized attempt to link or use cards on the following platforms will result in instant and permanent account blocking:

• Google Ads / YouTube / Google Play

• Twitter Ads / Twitter

To use cards on these platforms, contact your manager for prior approval.

Trusted virtual cards for Affiliates

Best virtual credit card platfrom for teams and individuals

Immediate card issuance